Home Loan in Jaipur

Apply for Home Loan Online Jaipur

Get the Best Deal on Your Home Loan

We offer competitive home loan options with quick and easy application processes and approval times. Finding the best deals on home loans has never been easier, but with AyoRa Capitals, a home loan finance company in Jaipur, you can access the best deals from the top banks of India. Let’s make it possible for you together!

Discover the Benefits of Working with AyoRa Capitals for Home Loan

Our team of experts is committed to finding the greatest offers for our clients to give them the assistance and peace of mind they require. We make every process easy and stress-free to ensure our clients get the greatest financing choice.

- Competitive Interest Rates: Find the best home loan rates available.

- Flexible Repayment Terms: Select terms that work for your budget.

- Quick Approval Process: Timely loan approvals are achieved through quick processing.

- Personalised Loan Options: Tailored solutions to match your needs.

- Wide Range of Loan Products: Various options to suit different buyers.

- Expert Guidance: Dedicated support throughout your home loan journey.

Home Loan EMI Calculator Online

0

2000000

0

0

Your Amortization Details (Yearly)

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|

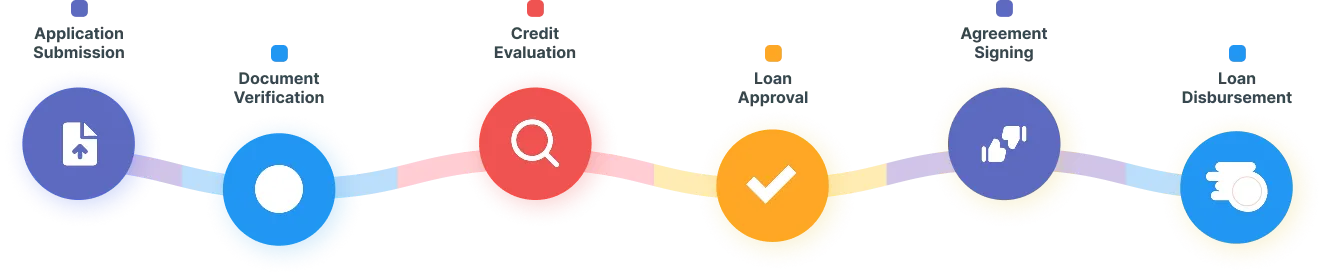

Home Loan Application Process

At AyoRa Capitals, we offer a simple and quick loan approval process to meet your financial goals and finalise the loan terms. Here’s the simple process:

Who Qualifies for a Home Loan?

Eligibility Criteria For Home Loan

Eligibility criteria for a home loan may vary depending on the lender, but generally, there are key factors that lenders opt for when determining whether you are the right candidate for a home loan. Here are some common eligibility requirements:

Key features and advantages:

-

Age: Must be between 18 and 65 years.

-

Income: Stable income to confirm you can repay the loan (proof of salary, tax returns).

-

Credit Score: A good credit score is a great deal, and lower scores may lead to higher interest rates.

-

Existing Debts: Less existing debt makes you a better candidate.

-

Nationality/Residency: Must be an Indian citizen or eligible foreign national.

-

Property Valuation: The property’s value should meet the lender’s requirements.

Enjoy Home Loan Benefits: Step into Your New Beginning!

Key Features and Benefits of Home Loan

“A home loan offers numerous advantages, making it an appealing option for many individuals and providing financial flexibility. “

-

Tax Deductions: Claim deductions on principal and interest payments under Sections 80C and 24 of the Income Tax Act.

- Easy Repayment Options: Enjoy flexible repayment options with longer tenures (up to 30 years).

-

Attractive Interest Rates: Lower interest rates mean affordable EMIs that suit your needs.

-

Improvement in Credit Score: With timely payments, you can improve your credit score.

-

Build Property Ownership: Helps you own a property and live rent-free.

Frequently Asked Questions

1. What is home loan EMI?

Your monthly housing loan in Jaipur payment as EMI (Equated Monthly Installment) combines principal and interest amounts into one fixed monthly payment.

2. What types of home loans are available in India?

There are many types of home loans available in India. The most common are online home loans for buying brand-new properties and existing homes. A home construction loan is used to finance the construction of an entirely new residence. A home improvement loan is for repairs or renovations. A land purchase loan serves to acquire land to build a home on it.

3. How to apply for a Home Loan?

The process to obtain a loan starts with selecting a lender and then completing their application form before submitting income proofs alongside identification documents and property information. The lender performs a thorough evaluation of your credentials to grant loan approval.

4. How much home loan can I get?

Your loan amount will be approved based on an assessment of your income, credit score, and property value determination. Your available loan amount extends to 80-90% of the property value.

5. Is there any tax benefit available on Home Loans?

Yes, according to Sections 80C and 24 of the Income Tax Act, you can deduct the costs of your home loan from your taxes.

6. What are the tax benefits associated with a home loan?

Principal Repayment: Up to ₹1.5 lakh under Section 80C.

You can deduct ₹2 lakh of interest paid from your income tax through Section 24(b) for properties you occupy yourself. First-time homebuyers qualify for an extra tax incentive of ₹50,000 through Section 80EE, provided they meet specified requirements.

7. What is the average tenure of a home loan?

Home loans usually end after a period of 20 to 30 years, yet the duration may differ based on lender policies or personal loan requirements. Also, you can calculate your loan using our online home loan calculator.

8. What are the documents required to apply for a Home Loan?

Identity proof & address proof of individuals

DOB Proof, including Passport/ Driving License/ Voter ID

Address Proof

Income Proof

9. Why choose AyoRa Capitals for homes?

At AyoRa Capitals, we understand the importance of being rent-free; that’s why we offer dedicated home loan guidance that helps you become financially independent. A home is more than just a place; it’s a place where we create many memories with our family. It’s our happy place, and that’s why we tailor loan options that meet your goals, budget, and preferences. So, when you choose us, you get full support and guidance that helps you make better decisions that you don’t regret.

10. How can I contact AyoRa Capitals?

You can directly contact us through the website, and our team will be there to assist you in making the best decision that suits your needs and budget. We have assisted our many customers to build their dream house. Contact us today whether you need an online home loan or a house renovation loan in Jaipur!

Success Stories from Our Borrowers

What’s holding you back from achieving your goals?

From seamless loan approvals to comprehensive insurance solutions and realty expertise, we connect you to possibilities that transform dreams into reality. Let’s build your future, together!