Business Loan in Jaipur

Instant Loan for Business in Jaipur

Need Funds Fast? Get Instant Business Loans Right Here!

We offer instant business loans online in Jaipur with flexible payments, instant approvals, and no hidden charges. Get an instant loan for a new business or a startup business loan in Jaipur at a lower interest rate.

Discover the Benefits of Working with AyoRa Capitals for Business Loan!

Our team of experts is committed to finding the greatest offers for our clients to give them the assistance and peace of mind they require. We make every process easy and stress-free to ensure a seamless experience, helping clients secure the best Business

loans in Jaipur.

- Quick and Easy Loan Process: Our team provides quick Business loan disbursement.

- Flexible Repayment Terms: Select terms that work for your budget.

- Wide Range of Loan Products: Various options to suit different buyers.

- Lower Interest Rates: Find the best interest rate for Business loans online in Jaipur.

- Dedicated Support: Offering personalized assistance, ensuring smooth loan management.

- Easy Online Application: Apply online anytime at your convenience.

Business loan Calculator

0

2000000

0

0

Your Amortization Details (Yearly)

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|

Apply for a Business Loan Online

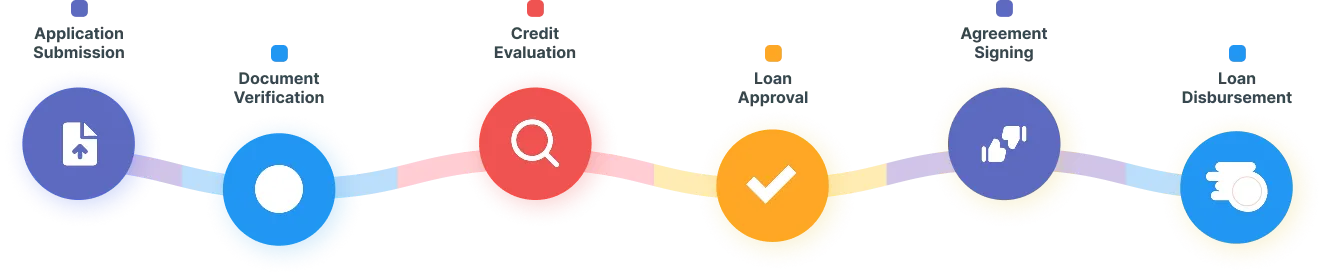

At AyoRa Capitals, we offer a simple and quick business loan approval process to meet your financial goals and finalise the loan terms. Here’s the simple process.

Simplified Business Loan Eligibility!

Business Loan Eligibility Criteria

For quick business loan approval in Jaipur from AyoRa Capitals, you can contact us, and our team will help you with the eligibility criteria for easy-to-meet loans.

Age of the Business: The business must be operational for at least 1 to 2 years.

- Type and Size of Business: business loans usually depend on the type and size of the business.

- Credit Score: A higher credit score can help with quick business loans. Credit Score should be 650 or above.

- Existing Liabilities: You should have fewer or no debts to increase the chances of qualifying for a new loan.

- Documentation: ID proof & address proof, passport-size photographs, and GST registration are needed to qualify for the loan.

- Bank Statements: The last 6-12 months of bank statements will be needed.

- Minimum Income: Rs 1 lakh p.a.

Unlock New Opportunities with the Right Business Loan

Features and Benefits of Business Loan

Competition Interest Rates: Enjoy the best interest rates on business loans that are tailored to your income, creditworthiness, and repayment ability.

- Quick Approvals: Business loans are typically approved quickly, with disbursement in a short time. Because we don’t want you to have a loss.

- Low-Interest Rates: Offering competitive interest rates, making repayment easier.

- Flexible Repayment Terms: Customise repayment schedule, allowing monthly, quarterly, or annual payments.

- No Restrictions on Use: Use the funds for various business needs, including business expansion, inventory, equipment purchase, or marketing.

- Minimal Documentation: Only a few documents for identity proof and verification.

Frequently Asked Questions

Why choose a Business Loan?

A business loan is like a helping hand when you need quick access to capital to meet your business expenses, whether it is MSMEs or large businesses. Therefore, with the help of a business loan, you can retain full control over your company and manage the expenses better for different business requirements.

What are the documents required for a Business Loan online in Jaipur?

The following documents are needed for a business loan: PAN Card, Aadhaar Card, Passport, Voter’s ID Card, Driving License, Address Proof, Bank statement for the previous 6 months, and other essential documents that may depend on the bank.

What is a Business Loan EMI calculator?

A business loan EMI calculator is an online tool that helps you estimate the total amount you will pay in the loan tenure with interest. This tool helps all small or large business owners to plan their finances and cash flow accurately. Click here to use the EMI calculator.

How to apply for a Business Loan?

The process is simple: contact a lender, and they will help you get access to the best loan option that meets your needs and goals. Fill out the form, attach the necessary documents, and maintain a good credit score.

When should you take a Business Loan?

You can take a business loan to meet your business needs, manage business expenses, manage downtime, grow your business, or make urgent expenditures.

What are the types of Business Loan?

Following are the types of business loans: Term loans, Startup loans, Working capital loans, Secured loans, Equipment financing or equipment loans, etc.

Who is Eligible for a Business Loan?

Eligibility for a business loan includes MSMEs with at least 1-2 years of operation, Private Limited Companies, Limited Liability Partnership Firms, Public Limited Companies, or self-employed individuals. With consistent revenue and a positive credit history, businesses can get a pass for a business loan. Startups can also qualify with a solid business plan. Therefore, the eligibility criteria can vary depending on the lender’s business loan scheme.

Is part payment allowed in Business Loans?

Yes, many banks allow partial payment to repay business loans.

How long does it take to sanction a Business Loan?

It can vary depending on the lender process. Usually, it takes a few days to a couple of weeks to sanction the business loan.

Why Choose AyoRa Capitals for a Business Loan?

AyoRa Capitals offers the best customer service and guides you through the process of making the right decision. We offer affordable interest rates, require minimal documentation to process the loan, and offer quick disbursal after a loan approval. Whether you need a small business loan in Jaipur or you are a startup business, we can help you get the best loan that effectively fulfils your business needs.

Success Stories from Our Borrowers

What’s holding you back from achieving your goals?

From seamless loan approvals to comprehensive insurance solutions and realty expertise, we connect you to possibilities that transform dreams into reality. Let’s build your future, together!