Msme Loan in Jaipur

Apply for an MSME loan online in Jaipur!

MSME Loan for Business Growth!

AyoRa Capitals is the trusted platform for MSME loans in Jaipur, offering low MSME interest rates that just align with your budget and goals. So, let’s elevate your business to new heights with a seamless process.

Discover the Benefits of Working with AyoRa Capitals for MSME Loan!

Our team of experts is committed to finding the greatest offers for our clients to give them the assistance and peace of mind they require. We make every process easy and stress-free to ensure a seamless experience, helping clients secure the best MSME loans in Jaipur.

- Quick and Easy Loan Process: Our team provides quick MSME loan disbursement.

- Flexible Repayment Terms: Select terms that work for your budget.

- Wide Range of Loan Products: Various options to suit different buyers.

- Lower Interest Rates: Find the best interest rate for MSME loans online in Jaipur.

- Dedicated Support: Offering personalized assistance, ensuring smooth loan management.

- Easy Online Application: Apply online anytime at your convenience.

MSME loan Calculator

0

2000000

0

0

Your Amortization Details (Yearly)

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|

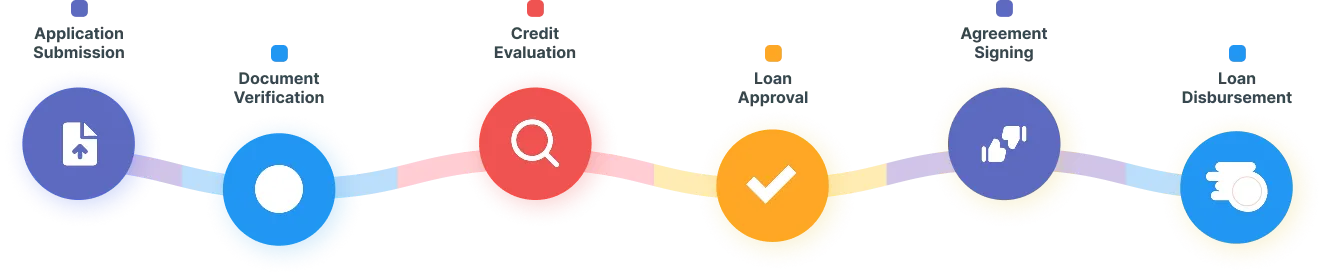

MSME Loan Application Process

At AyoRa Capitals, we offer a simple and quick MSME loan approval process to meet your financial goals and finalise the loan terms. Here’s the simple process:

MSME Loan Eligibility

Meet these MSME loan eligibility requirements, and you can quickly get the loan to grow your small to medium business.

Applicant age: A minimum age of 21 is necessary for applying for a loan.

Age of the Business: The business must be operational for at least 1 to 2 years.

History: Good repayment history and financial stability.

Credit Score: Good credit score and creditworthiness

Bank Statements: The last 6-12 months of bank statements will be needed.

Documentation: ID proof & address proof, passport-size photographs, lease agreement, rental agreement, and GST registration are needed to qualify for the loan.

Key Features of MSME Loan

Attractive Interest Rates: Enjoy the best interest rates tailored to your income, creditworthiness, and repayment ability.

Quick Disbursement: Streamlined MSME loan process for faster disbursals.

Flexible Repayment: Enjoy flexible repayment terms.

Credit Score Building: MSME loans can help build credit history.

No Restrictions on Use: Use the funds for various business needs, including business expansion, inventory, equipment purchase, or marketing.

Minimal Documentation: Only a few documents for identity proof and verification are needed.

Frequently Asked Questions

Why MSME Business Loan?

By taking an MSME business loan, small to medium business owners can meet their small business requirements and upgrade their technology to the sector requirements. This helps small businesses grow and upgrade to new heights.

How much EMI do I need to pay?

You can calculate your EMI easily with the help of the EMI calculator, which helps you know exactly what amount you should pay, allowing you to manage your budget better. To use the EMI calculator, click here.

Can I also get an MSME Loan on industrial property?

Yes, you can get an MSME loan on industrial property in Jaipur easily. You just need to meet the eligibility criteria to get an MSME loan. Micro, Small, and Medium businesses can enjoy the benefits of MSME loans.

How much of an MSME loan for business can I get?

You can get up to ₹15 lakh or up to ₹50 lakh in some. To know more about the loan amount, you can contact us. Our team will be there to guide and support you throughout the process.

Can I get an MSME Loan for my warehouse?

Yes, you can get an MSME loan in Jaipur for your warehouse. These loans are specially designed to expand your small business and grow more.

How can I apply for an MSME loan for business?

To apply for a loan near me, you must check your eligibility to take a loan for your business. Fill out the application, attach the necessary documents, and submit the documents. Your loan application will be evaluated, and if your application is approved, you need to sign the agreement, and your amount will be disbursed.

How long can it take to repay the MSME loan?

The loan term usually ranges from 1 to 5 years, depending on the loan amount, business financial status, and lender. We offer flexible repayment options so that you can repay the amount without any burden or stress. If you want to explore the best repayment options based on your business needs, contact us now.

What do you mean by a Non-Banking Financial Institution?

A Non-Banking Financial Company provides financial help and services from the most reputed and trusted banks, but these non-banking financial institutions do not offer you regular banking services like banks have. So, these non-banking companies offer you a variety of loan options from lenders at affordable interest rates, whether you need an MSME loan for a startup, an MSME loan for a new business, or to grow your small business.

Why choose AyoRa Capitals for an MSME Loan?

At AyoRa Capitals, we provide you with the best MSME loans that give you the best interest rates and flexibility to repay the loan. Our main aim is to make your loan process hassle-free with minimum paperwork. Businesses of all sizes, from small to medium, can easily get MSME loans quickly. Apply for an MSME working capital loan today!

Success Stories from Our Borrowers

What’s holding you back from achieving your goals?

From seamless loan approvals to comprehensive insurance solutions and realty expertise, we connect you to possibilities that transform dreams into reality. Let’s build your future, together!