Car Loans in Jaipur

Apply for Car Loan Online Jaipur

Fast, simple car loans with affordable EMI options

We offer online car financing, flexible payments, instant approvals, and no hidden charges. Finance your car today and start your road journey today. We offer the best offers on car loans online in Jaipur at lower interest rates with good credit scores.

Discover the Benefits of Working with AyoRa Capitals for Car Loan!

Our team of experts is committed to finding the greatest offers for our clients to give them the assistance and peace of mind they require. We make every process easy and stress-free to ensure a seamless experience, helping clients secure the best Car

loans in Jaipur.

- Quick and Easy Loan Process: Our team provides quick Car loan disbursement.

- Flexible Repayment Terms: Select terms that work for your budget.

- Wide Range of Loan Products: Various options to suit different buyers.

- Lower Interest Rates: Find the best interest rate for Car loans online in Jaipur.

- Dedicated Support: Offering personalized assistance, ensuring smooth loan management.

- Easy Online Application: Apply online anytime at your convenience.

Car Loan EMI Calculator

0

2000000

0

0

Your Amortization Details (Yearly)

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|

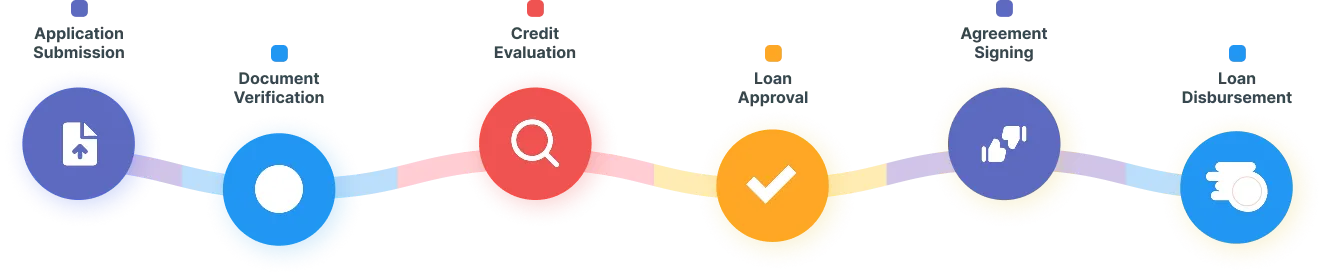

Car Loan Application Process

At AyoRa Capitals, we offer a simple and quick online car loan approval process to meet your financial goals and finalise the loan terms. Here’s the simple process:

Car Loan Eligibility Criteria

For quick car finance in Jaipur from AyoRa Capitals, you can contact us, and our team will assist you with the easy-to-meet eligibility criteria. Applicant’s loan for car eligibility criteria depends on multiple factors, including:

Key features and advantages:

- Age: The minimum Age of the Applicant should be 18 years.

- Type of car: The type of car you are purchasing.

- Income: Stable income to confirm you can repay the loan (proof of salary, tax returns).

- Credit Score: A good credit score is a great deal, and lower scores may lead to higher interest rates.

- Nationality/Residency: Must be an Indian citizen or eligible foreign national.

- Other Documentation: This includes address proof, age proof, or bank statements

- Existing Loan: Having too many existing loans can reduce your chances of getting a personal loan, as lenders may be concerned about your ability to repay the loan.

Your Dream Car, Within Reach – Convenient EMI Options!

Key Features and Benefits of Car Loan

“Loans help you make an investment when you need it most. With a car loan, you can have your own car that offers comfort for you and your family when needed. “

- Quick loan disbursement

- Provides optional health cover

- Minimal paperwork.

- Buy a new or pre-owned car

- Repay the loan with a suitable payment mode

- Borrowers can prepay the loan amount

- A good credit score leads to affordable interest rates

- Car loan tenure ranges from 1-7 years

- Fixed Repayment

Frequently Asked Questions

What types of car loans in Jaipur are available?

These are the types of car loans, including new car loans, used car loans, personal car loans, and private-party car loans. To learn more about car loans, you can contact us directly without any hesitation. Our team will help you get the best car loan that meets your goals and budget.

Can I receive a car loan with 100% funding?

Yes, you can get 100% funding with a car loan for the selected models. Many banks offer 100% funding. If you are looking for a car loan, contact us, and we will offer you the best car loan that meets your goals. So, buy your dream car with 100% funding.

Do I require a guarantor or security when applying for a new car loan?

Generally, there is no need for a guarantor or security to pay the car loan. A guarantor is usually required when the borrower has a bad credit score or repayment history.

What is the required CIBIL (credit score) for a car loan?

If you need a car loan, a CIBIL score of 750 or higher is crucial to get the best interest rates and terms. A score between 700-749 is considered a good credit score, while a credit score below 700 is a bad score, and your loan may not be approved or may lead to higher interest rates.

Can I prepay the full loan amount in advance? Will they charge me a penalty?

Of course, you can pay the full loan amount in advance, but some banks may charge a penalty. It is better to ask your provider and consult with them.

How much EMI will be payable for a new car loan?

The payable EMI amount can vary depending on factors such as loan amount, interest rate and loan tenure. These factors can affect the total EMI you need to pay for a new car loan. To calculate the EMI for your car loan, click here.

What are the minimum and maximum tenures of a Car Loan?

Many banks offer a maximum tenure of 7 years. Usually, the minimum is 12 months, and the maximum is 84 months. Contact us for a tailored approach.

Where can I avail of car loan offers?

We help you get the best car loan options from the most trusted banks, including HDFC, IDBI, ICICI, PNB Housing, Bank of Baroda, and Bank of India. With our tailored approach, you can live your dream of a brand-new car with instant car loan approval in Jaipur. Contact us today!

Which bank provides the cheapest car loan?

There are many banks that offer cheap car loan options, including HDFC. Contact us for more details.

What are the benefits of applying for a car loan with AyoRa Capitals?

We provide you with the necessary tools and the best solutions tailored to your needs and budget. We bring the most trusted and leading banks to the table to meet your specific requirements. Our team offers the best interest rates, maximum loan amount, suitable tenure, and other factors. Our auto loan online approval process is quick and easy so that you don’t have to wait and enjoy a hassle-free process. Also, we offer ongoing support and guidance so that you can choose the right loan option.

How to use the EMI car calculator?

Loans help you in emergency situations and meet your personal needs. Therefore, a loan becomes a successful tool for those who handle it appropriately. So, if you are dreaming of buying a high-class car, but your pocket doesn’t allow for purchasing. So, use the EMI calculator to make the right purchase with the right decision and repay your loan without unnecessary pressure. Click here for the EMI car loan calculator.

Success Stories from Our Borrowers

What’s holding you back from achieving your goals?

From seamless loan approvals to comprehensive insurance solutions and realty expertise, we connect you to possibilities that transform dreams into reality. Let’s build your future, together!