Personal Loan in Jaipur

Get Instant Personal Loan Online Jaipur

Find the Right Personal Loan for You Today!

Are you looking for personal loan options to fulfil your dreams? What’s stopping you from then? Call us, and we will help you get an instant personal loan in Jaipur from the leading banks. Enjoy quick personal loan approval, lower interest rates, no complex documentation, and a loan that perfectly fits your needs and budget. Whether you need a 50,000 or 5 lakh loan, our team will make your loan approval process hassle-free!

Discover the Benefits of Working with AyoRa Capitals for Personal Loan Loan!

Our team of experts is committed to finding the greatest offers for our clients to give them the assistance and peace of mind they require. We make every process easy and stress-free to ensure a seamless experience, helping clients secure the best Personal

loans in Jaipur.

- Quick and Easy Loan Process: Our team provides quick Personal loan disbursement.

- Flexible Repayment Terms: Select terms that work for your budget.

- Wide Range of Loan Products: Various options to suit different buyers.

- Lower Interest Rates: Find the best interest rate for Personal loans online in Jaipur.

- Dedicated Support: Offering personalized assistance, ensuring smooth loan management.

- Easy Online Application: Apply online anytime at your convenience.

Personal Loan EMI Calculator

0

2000000

0

0

Your Amortization Details (Yearly)

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|

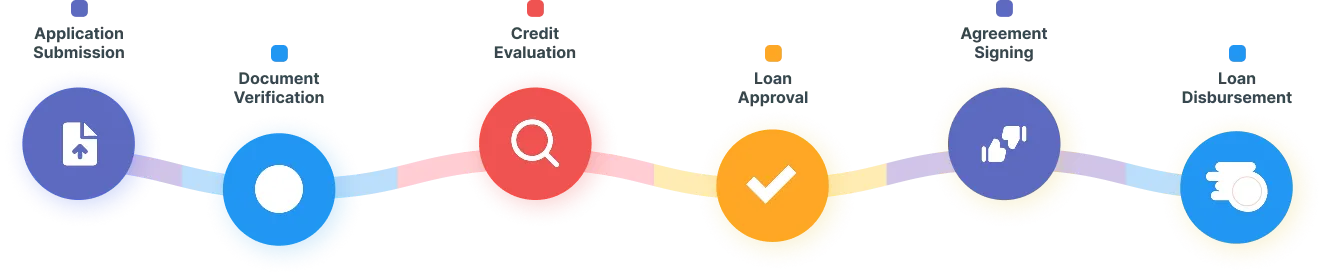

Personal Loan Application Process

At AyoRa Capitals, we offer a simple and quick personal loan approval process to meet your financial goals and finalise the loan terms. Here’s the simple process:

Eligibility Criteria for Personal Loan Online in Jaipur

Why Choose Our Personal Loans?

For a quick personal loan in Jaipur from AyoRa Capitals, you can contact us, and our team will assist you with the easy-to-meet eligibility criteria. Applicant’s personal loan eligibility criteria depend on multiple factors, including:

Key features and advantages:

-

Age: Individuals between 21 and 60 years of age.

-

Income: Stable income to confirm you can repay the loan (proof of salary, tax returns).

-

Credit Score: A good credit score is a great deal, and lower scores may lead to higher interest rates.

-

Existing Debts: Less existing debt makes you a better candidate.

-

Nationality/Residency: Must be an Indian citizen or eligible foreign national.

-

Other Documentation: This includes address proof, age proof, or bank statements

-

Existing Loan: Having too many existing loans can reduce your chances of getting a personal loan, as lenders may be concerned about your ability to repay the loan.

Key Features and Benefits of Personal Loan

Key Features & Advantages:

“Owning a home is a major milestone, and we are here to make it easier for you. Our home loan solutions offer competitive interest rates, flexible repayment options, and minimal paperwork, ensuring a smooth journey to your dream home.”

-

Quick Funding and Easy Documentation: You need only a few identity proofs, including your address proof and income, to apply for the loan. You can also make the loan process online without any complications. Your details will be verified for loan approval. Then, the funds will be credited to your account within 48 hours.

-

Flexibility with Personal Loan: Personal loans have no limitations, making them easy to use for expenses. Whether you need home renovation to clear your debts or for other expenses, it gives you the flexibility to do multiple jobs with a single loan.

-

Attractive Interest Rates: You can enjoy the best interest rates on personal loans that are tailored to your income, creditworthiness, and repayment ability. So, the loan will align with your goals and budget with lower interest rates and affordable EMIs.

-

Fixed Repayment: With a personal loan, you don’t have to mess up your monthly budgets; the loan offers fixed repayment schedules that offer ease and flexibility in planning your future. There are no hidden costs. You have to pay the same fixed amount.

-

Good Credit Score: You can maintain a good credit score when you pay your EMIs on time, helping you build a strong and positive impact based on your history. This includes timely bill payments, low credit card balances, and avoiding undue debt. Therefore, a good credit score is crucial for applying for a loan in the future.

Frequently Asked Questions

What is a personal loan?

A personal loan is an unsecured loan provided by banks with minimal documentation, where you borrow money from the bank in large amounts to meet your needs, whether it is medical emergencies or personal debts.

What are the types of personal loans?

There are different types of personal loans, including medical loans, home renovation loans, business loans, loans for travel, debt consolidation loans, education loans, or for other personal expenses. Contact us to get quick approval on personal loans.

What are the reasons that the financial lender can reject my application for a personal loan?

If you do not meet the eligibility criteria regarding age, credit score, past repayment history, work experience, income, etc. Talk to your financial lender to learn how you can get a personal loan or find other options that meet your goals.

Is there any fee to fill out a personal loan application form?

No, there is no personal loan application online form fee; you can directly fill out the form with the required documents.

What is the lowest salary for a personal loan?

The minimum salary for a personal loan is rupee 25,000 per month.

What is the repayment tenure for personal loans?

The repayment tenure is mostly between 1 year and 5 years, based on convenience.

What should I look for before applying for a personal loan?

These are the few things that you should consider when applying for a personal loan:

Check for interest rates: Check on our personal loan EMI calculator.

Repayment Flexibility: Ensure you are allowed to repay the loan in part-payments or pre-payments and check if there is any penalty charged for making the pre-payment.

For the processing fee, check for the high processing fee.

Ensure that the lender offers good customer care services so that you can clear your doubts whenever needed.

Is pre-payment allowed for personal loans?

Yes, many lenders may allow you to make pre-payments, but it is also crucial to ensure that there are no penalty charges.

Why choose AyoRa Capitals for a personal loan?

AyoRa Capitals, a personal loan provider in Jaipur, offers reliable and tailored solutions for each individual’s unique needs. We understand the urgency of the loan and offer a quick loan approval with an easy process. We offer minimal paperwork and disburse the amount quickly on approval. With us, you can make better decisions for the future. Contact us today to get the best online personal loans.

When should I opt for a personal loan?

You must opt for a personal loan when you need it urgently, like when there is a medical emergency or an urgent situation.

What can I use a Personal Loan for?

You can use a personal loan for any expenses, such as meeting personal debts, education, renovating your home, traveling, dealing with medical emergencies, or other expenses.

What is the maximum personal loan amount that I can avail myself of?

The maximum amount is ₹25 lakhs to ₹50 lakhs, which can also depend on your income, lender terms and conditions, credit score, and other financial factors. Some banks may offer higher loan amounts.

How to apply for a Personal Loan?

Just fill out the application form, provide the required documents, and check loan eligibility. If your loan is approved, you will receive the amount in your bank account. If you want to calculate your personal Loan EMI and more. Click Here.

How much time does it take to get an instant loan application approved?

The approval of your loan can depend on the complexity of your application. Therefore, it usually takes minutes to hours for loan application approval.

Success Stories from Our Borrowers

What’s holding you back from achieving your goals?

From seamless loan approvals to comprehensive insurance solutions and realty expertise, we connect you to possibilities that transform dreams into reality. Let’s build your future, together!