AyoRa Capitals Your Trusted Partner!

Smart Solutions for Life’s Big Moments!

AyoRa Capitals is your trusted partner in providing access to the right financial support, whether you need loans, selling, buying, relocation services or insurance services. We help simplify the entire process for you and allow quick solutions. Our trusted lending partners are HDFC Bank, IDBI Bank, ICICI Bank, PNB Housing, Bank of Baroda, and Bank of India. Finding the best solution in life is not easy, but don’t worry; we will make it effortless for you!

10,000+

Happy Clients

10+

Years Experience

95%

Success Rate

30+

Dreams Financed

Your Trusted Partner in Insurance, Realty, and Loans!

We work closely with you to offer the best support throughout the loan process, including buying, selling, relocation services, and insurance. Partnering with trusted and renowned banks like HDFC, PNB, and more, we bring a wide range of loan options to suit your needs. Our goal is to provide tailored solutions and ensure you receive the best possible outcome. With our quick, safe, and reliable services, you can fulfill your dreams of buying a new car or home. Ready to find the perfect loan solution? Contact us today!

Flexible Loan Solutions

for Every Goal.

Comprehensive Insurance

for Your Peace of Mind

Real Estate Services

You Can Trust

Types of Loans You Can Benefit From

AyoRa Capitals is here to help!

At AyoRa Capitals, our platform is designed to help people with an easy and quick loan application solution tailored to their goals. We make the loan journey easy and stress-free, which may seem complicated for others. Our team provides the right guidance to help you access the best loan type. We provide clear, detailed information so you can make well-informed decisions.

We offer many types of loans that cater to your unique needs. When you work with us, you save time, avoid confusion, and get the loan that suits your needs, all with minimal effort. We make your loan journey easy and smooth so you can focus on your goals.

HOME LOAN

Secure your dream home with ease.

PERSONAL LOAN

Flexible loans for personal financial needs.

CAR LOAN

Drive your dream car today!

BUSINESS LOAN

Fuel your business growth with funds.

EDUCATION LOAN

Achieve your education goals effortlessly.

MSME LOAN

Empower your MSME with easy financing.

Why Choose AyoRa Capitals

Trusted Partnerships:

Reliable services for loan options from the most trusted banks, like HDFC, selling or buying house, relocation & insurance services.

Easy Process & Low Interest Rates:

We offer a simple and hassle-free process at lower interest rates.

Experience:

Providing reliable and knowledgeable guidance across insurance, realty, and loan services, ensuring better decisions.

Expert Guidance:

Our team offers expert guidance and support at every step, ensuring you stay stress-free.

Trusted Solutions for Life, Home, and Beyond!

Take the first step towards achieving your dreams with AyoRa Capitals. We will help you reach your goals with ease and efficiency. We are here to help you and support your dreams, whether it’s loan process, selling or buying a house, relocation services, or insurance services. We will help you achieve your dreams with the right expertise!

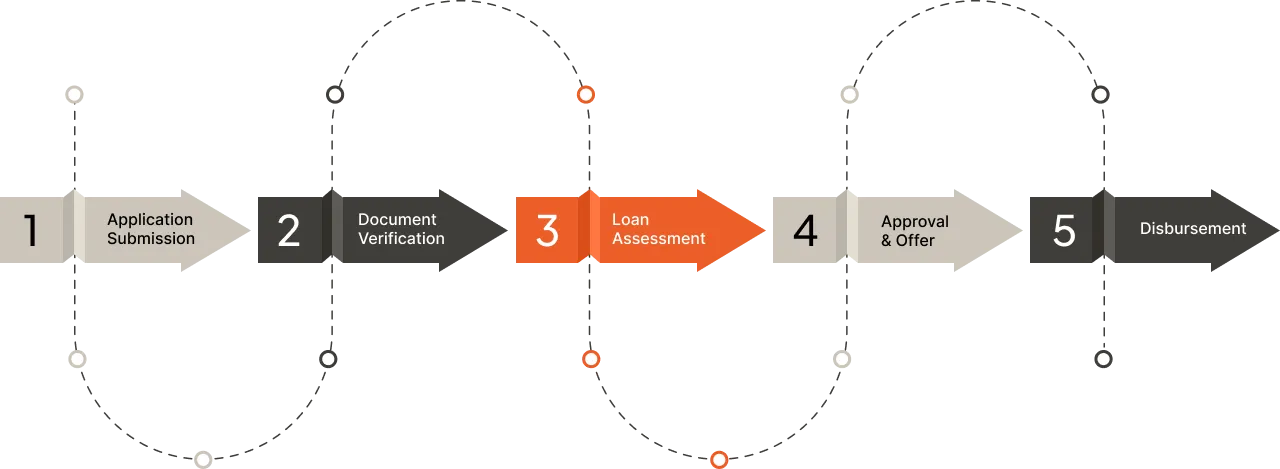

Get Loan in 5 Simple Steps

The fund will be disbursed to the borrower’s account.

We will issue a loan and offer terms and conditions.

We will assess the borrower’s creditworthiness.

We will review the borrower’s submitted documents.

Fill the loan application with the necessary documents.

Effortless Loan Application Process

Application Submission

Fill the loan application with the necessary documents.

Document Verification

We will review the borrower’s submitted documents.

Loan Assessment

We will assess the borrower’s creditworthiness.

Approval & Offer

We will issue a loan and offer terms and conditions.

Disbursement

The fund will be disbursed to the borrower’s account.

Success Stories from Our Borrowers

Frequently Asked Questions

Table of Content

- General

- Loans

- Insurance

- Realty

- Health Insurance

- Home Insurance

- Automobile Insurance

- Health Insurance

- Travel Insurance

Your process starts when you connect with members of our team.

For buyers, we can help identify what you need, explore financing options, and begin searching for the best properties that align with your goals.

For sellers, we provide market analysis, guidance on pricing, and marketing strategies to get your property noticed. We assist sellers by conducting market research to establish property worth and offering pricing and promotional guidance that maximizes property exposure.